Estimated Taxes January 2025

BlogEstimated Taxes January 2025. The due dates for quarterly estimated tax payments in 2025 are typically april 15, june 15, september 15, and january 15 of the following year. Published fri, jan 12 20242:09 pm est updated tue, jan 16.

Tax rates for the 2025 year of assessment Just One Lap, The estimated taxes are based on your income from 2025. Estimated tax is the government’s way to collect taxes on income that are not subject to withholding tax.

Calculadora Taxes 2025 Randi Carolynn, When are the quarterly estimated tax payment deadlines for 2025? When are federal estimated taxes for individual returns due?

Irs Estimated Tax Penalty Rate 2025 Doria, Annual tax filing deadlines for 2025. Published fri, jan 12 20242:09 pm est updated tue, jan 16.

IRS Refund Schedule 2025 When To Expect Your Tax Refund, Subsequent estimated tax payments would be due july 15, october 15, and. When are federal estimated taxes for individual returns due?

Irs Tax Day 2025 Deadline Elmira Kerrin, Who has to pay estimated taxes? Estimated tax is the government’s way to collect taxes on income that are not subject to withholding tax.

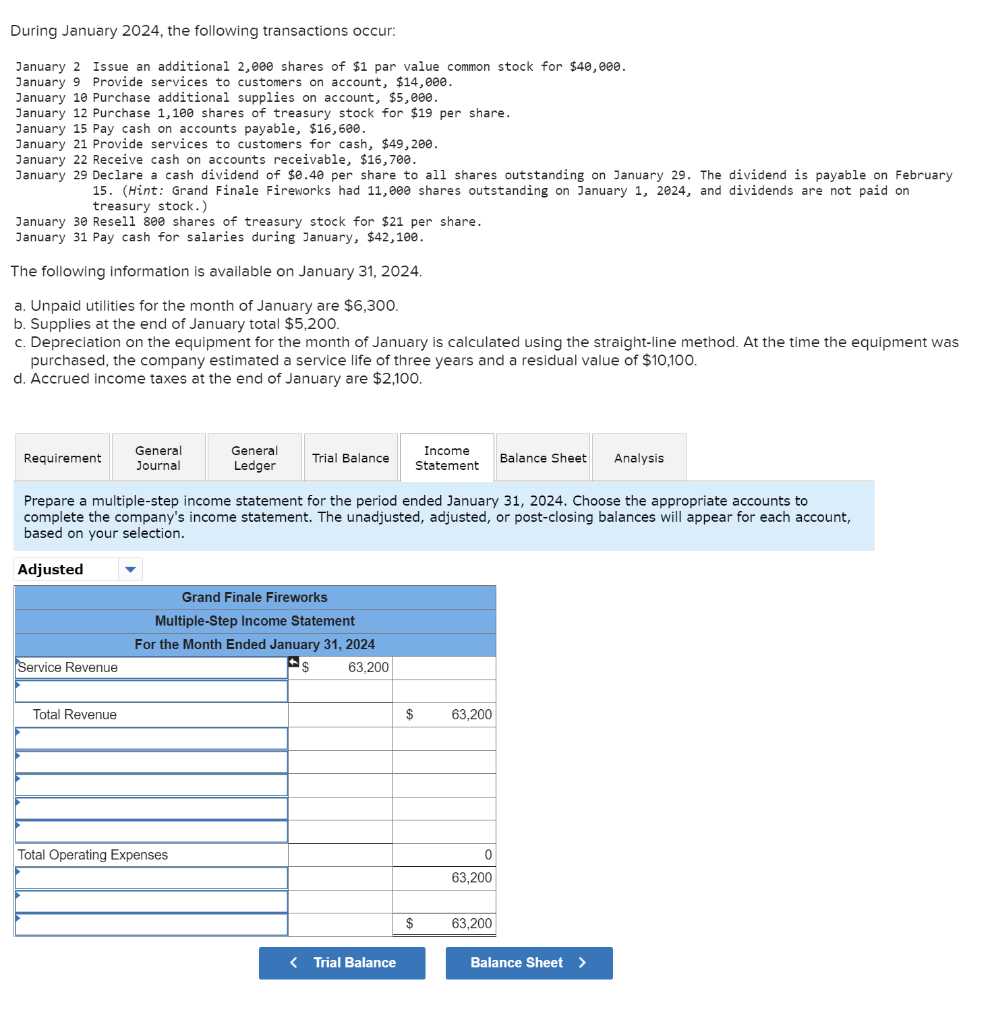

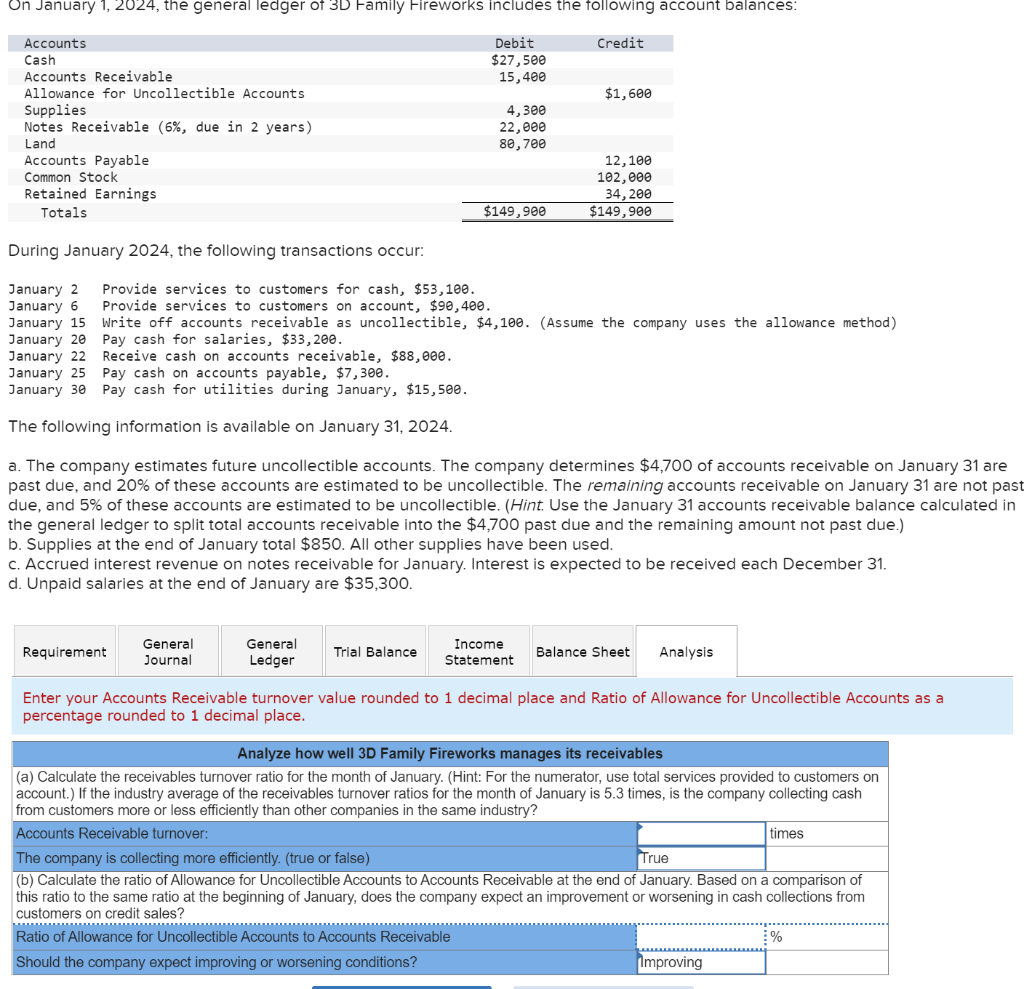

Solved During January 2025 , the following transactions, The provisional figures of direct tax collections up to 10th january, 2025 continue to register steady growth. Who has to pay estimated taxes?

Form 1040 ES, Estimated Tax for Individuals Internal Revenue Service, Federal holiday on monday, jan. friendly reminder your final installment of 2025 estimated taxes is due tomorrow january 16th, 2025.

Solved During January 2025 , the following transactions, These deadlines are crucial to. Fourth estimated tax payment for 2025 due.

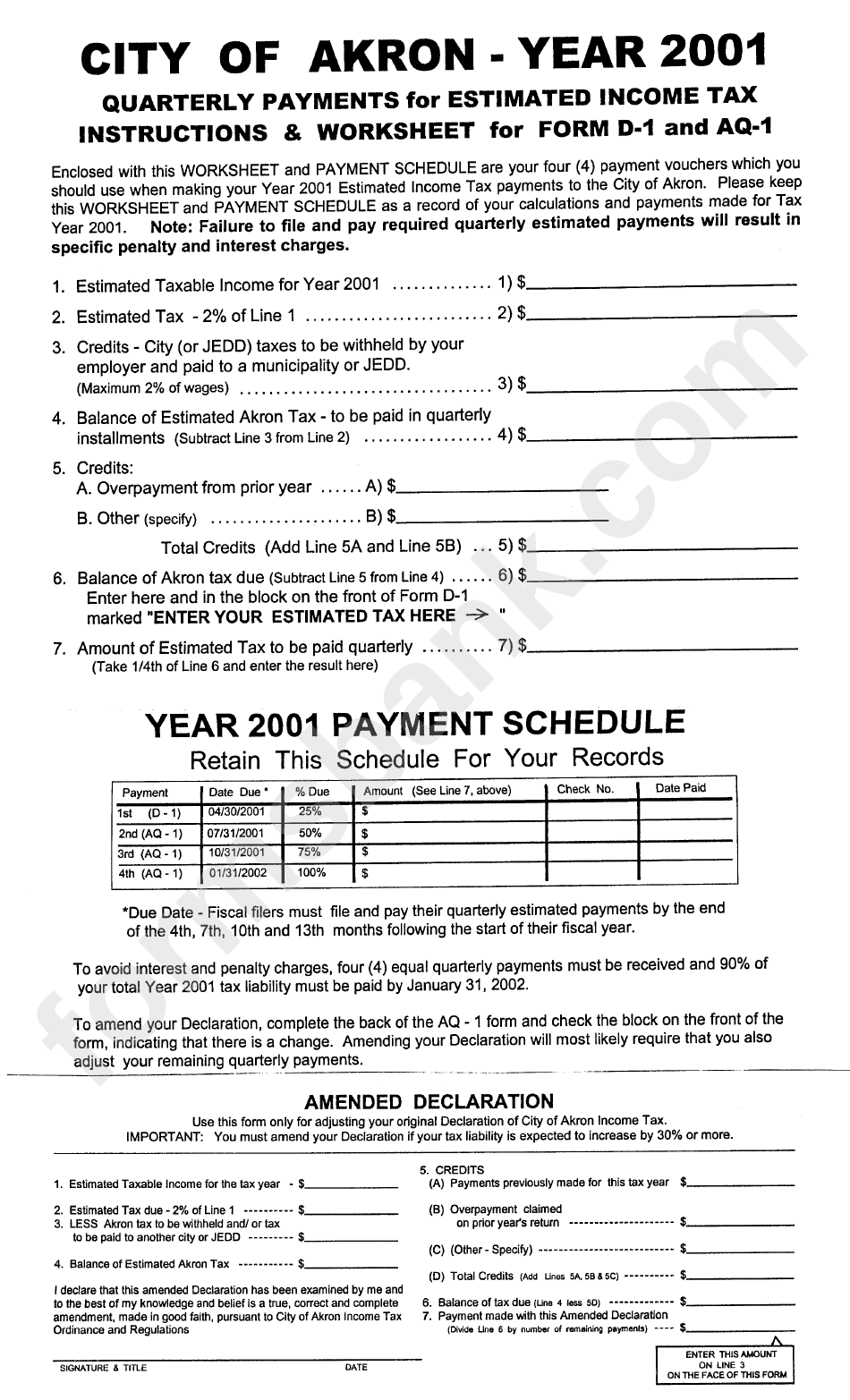

Quarterly Payments For Estimated Tax Form printable pdf download, Estimated tax is the government’s way to collect taxes on income that are not subject to withholding tax. The due dates for quarterly estimated tax payments in 2025 are typically april 15, june 15, september 15, and january 15 of the following year.

How to calculate estimated taxes 1040ES Explained! {Calculator, Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2025 tax return in 2025. 100% of your actual 2025 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if married filing separately) there are two additional irs.

31, 2025, and pay the entire balance due at that time, you won't have to make the final estimated payment for.

100% of your actual 2025 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if married filing separately) there are two additional irs.