Maximum 529 Contribution 2025 Illinois

BlogMaximum 529 Contribution 2025 Illinois. The 529 account must have been open for more than 15 years. Review how much you can save for college in these plans.

A 529 plan can be a great alternative to a private student loan. This article will explain the tax deduction rules.

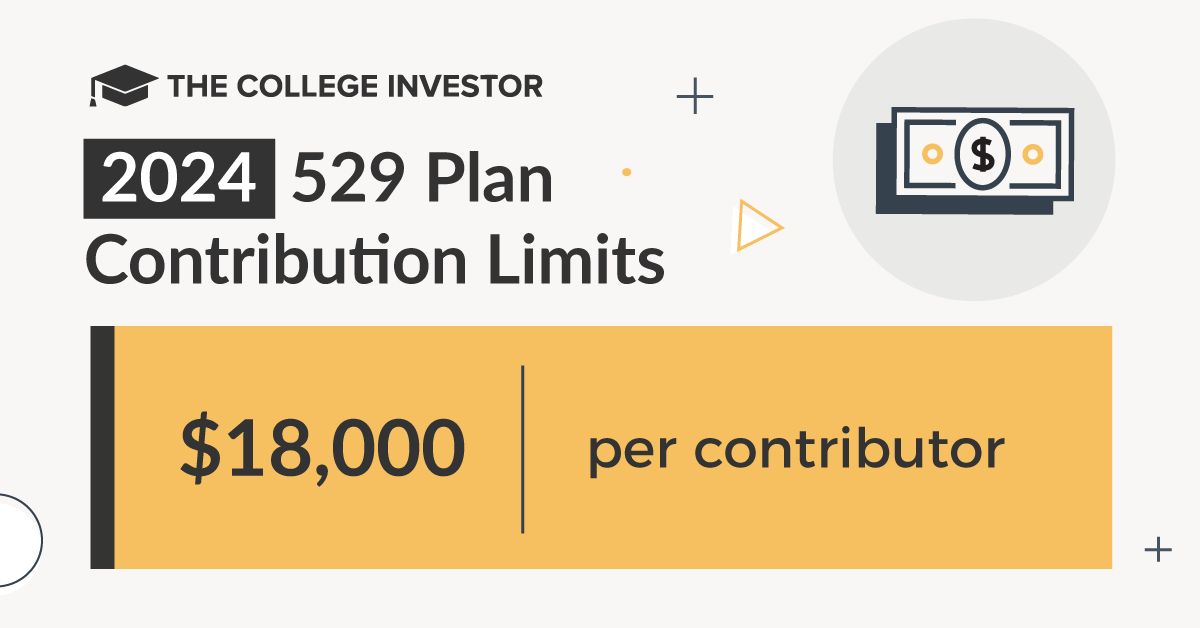

529 Limits 2025 Elset Horatia, 529 plans do not have an annual contribution limit. Since each donor can contribute up to $18,000 per beneficiary, a married.

Maximum 529 Plan Contribution 2025 Noemi Angeline, If you contribute an especially. Illinois offers a state tax deduction for contributions to a 529 plan of up to $10,000 for single filers and $20,000 for married filing jointly tax filers.

Max 529 Contribution Limits for 2025 What You Should Contribute, Currently, you can contribute up to $350,000 to your illinois 529 plan. This is an aggregate contribution limit, meaning the maximum total can be contributed to.

Max 529 Plan Contribution 2025 Inga Regina, The illinois 529 college savings plans allow families to save for the future cost of college while taking advantage of great federal and state tax benefits, great investment lineups,. This article will explain the tax deduction rules.

Irs 529 Contribution Limits 2025 Rory Walliw, This limit is subject to the annual roth ira contribution limit, which is $7,000 in 2025. However, the contribution limit may increase over time, allowing you to.

529 Limits 2025 Nani Pollyanna, Here's what you need to know about that maximum, employer matches and how much you should contribute to maximize your retirement savings. This article will explain the tax deduction rules.

Annual 529 Contribution Limit 2025 Rhona Cherrita, Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution. In 2025, individuals can gift up to $18,000 in a single 529 plan without those funds counting against the lifetime gift tax exemption amount.

529 Plan Contribution Limits Rise In 2025 YouTube, You can contribute as much money as you want, but there are tax incentives to stay within the gift tax limits. This article will explain the tax deduction rules.

529 Plan Maximum Contributions YouTube, A 529 plan can be a great alternative to a private student loan. Illinois offers a state tax deduction for contributions to a 529 plan of up to $10,000 for single filers and $20,000 for married filing jointly tax filers.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states. This is an aggregate contribution limit, meaning the maximum total can be contributed to.

In 2025, individuals can gift up to $18,000 in a single 529 plan without those funds counting against the lifetime gift tax exemption amount.